Finance Features and Way Out

What is the finance department studying?

The four-year course of study in the financial department can be divided into two phases:

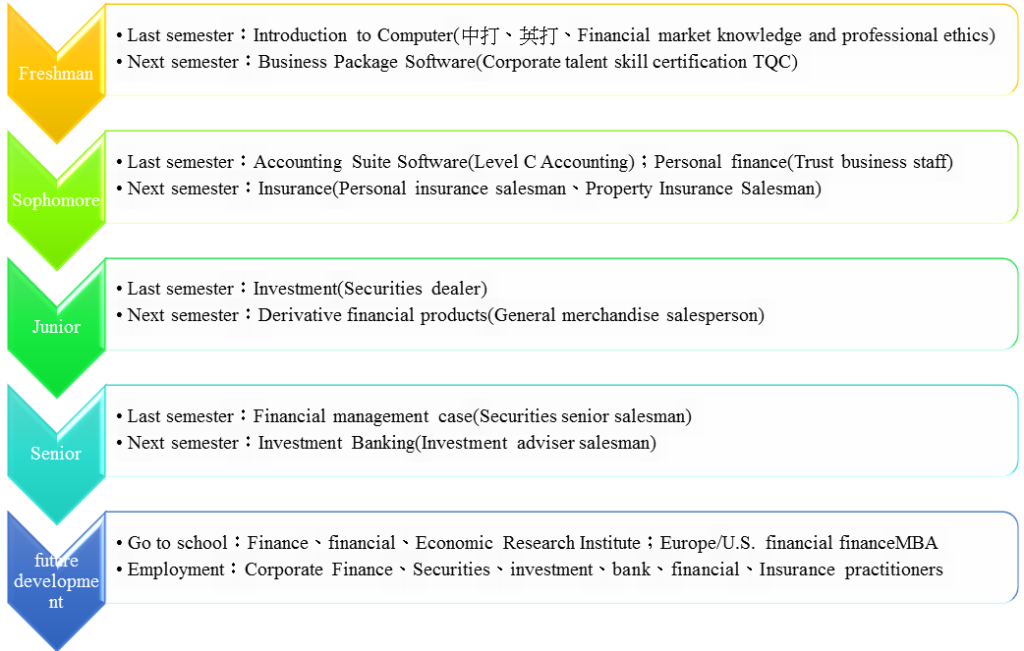

Basic cultivation period: This stage is mainly for students to understand the business language and logical thinking mode. Through the study of basic disciplines such as economics and accounting, you can understand the operation of the overall financial system and how to understand the operation of a company through business language. The course at this stage belongs to the basic subject. Freshman and sophomore are just in this period.

Professional area training: Through the professionalism of teachers and the need to follow the employment talents in the workplace, through the design of module courses, students are led to develop in various professional fields. The graduation of junior year to senior year belongs to this period.

In the professional field curriculum, the modular curriculum design is the focus. The department focuses on three module design courses.

(1)Corporate Finance Module

(2)Financial Services Module

(3)Investment Information Module

The company's financia module mainly guides students to design the company's accounting/finance department employment.

The financia services module is designed with specialized courses required in the three major areas of securities/banking/insurance.

The investment information modue emphasizes how to use various large-scale data such as economic, financial and corporate financial data to conduct investment analysis to improve investment efficiency.

Through the training of module courses, the most important activity of the department before graduation is the completion of the “graduation project”. Students must form a team and spend a year under the guidance of a teacher to conduct a topic on a financial or financial topic. Actually. This time is to test the students' knowledge of financial knowledge is not strong enough!

We design an effective way to cultivate your finance professional competence and employment competitiveness

Financial expertise + financial certification counseling + corporate internship!!! Let's take a closer look~

Financial certification guidance

We provide a complete plan for the certification examination process, combining the curriculum with the certificate and photography, so that when the students finish the course, they will obtain relevant professional licenses, and achieve a more efficient learning. This method will enable our freshman students to gradually accumulate the license required for employment. If you think about it, if you have a good financial professional ability, plus an endorsement of professional certification, whether it is in the job search, than the other Fresh people are more competitive?

Take a look at how we did it!!!!

Excellent results ~~~

In the 105 school year, a total of 64 people participated in the company's internship. After the internship, the rate of corporate retention is as high as 65%.

Choose the advantages of the Department of Finance of Evergreen University

A group of teachers with professional and good interaction with students: The teachers of this department have specialization, serious teaching and sincere care for students, and good interaction with students. There were 7 teachers in the department who received excellent teachers in the school and 5 teachers received excellent teachers in the school. Graduating faculty members also keep in touch with teachers and provide resources to school siblings.

The course combines certificate guidance with a rich student achievement: Over 50% of 105 graduates have more than 5 professional licenses, and 10 students have more than 10 professional licenses.

Students are highly motivated to practice in the financial industry and have a high employment retention rate: The Department is committed to student banking, securities, insurance, and accounting, etc. Financial professional certification guidance, and allows students to learn through financial internships, financial and accounting internships. Apply to practice, make the student have the job field is ready to fight, reach the target that graduates namely employment. From the 105 academic year to the financial industry and the company's accounting department, the number of students participating in the interns was 64, which was a 120% increase compared to the 104 school year.

There are three ways out of the financial system

The first good: good salary for employment

According to the 104 manpower bank survey conducted on February 4, 2018 (https://www.104.com.tw/jb/wage/list?type=1&jobcat=2003002000&cat=jobmanage), the average monthly salary of relevant personnel in the finance profession is 48,000 yuan. Everyone has 7.0 jobs. According to the “Freshman Employment Survey 2017” released by the 1111 Bank of Labor, the average monthly salary for freshmen is NT$27,850. If you look at the starting salary of freshmen in college graduates of various industries, use the “Finance and Insurance” 31K crown. In the year-end bonus section, the average year-end business year is 1.34 months, of which the year-end bonuses for financial-oriented "industrial and commercial services" are the highest.

The second is better: more jobs

With the increase in profitability and active recruitment in the financial industry in recent years, there are more job opportunities for graduates of the finance and economics departments. According to the 1111 Manpower Bank Survey (https://www.1111.com.tw/news/surveyns_con.asp?ano=110413), 60% of the 2 financial industry has already started the recruitment program for 2018, and the average number is 41. People, accounting for 10% of the company's average number of employees. In addition to the post-war manpower needs of the baby boomers preparing for retirement, it is also a major project for the financial industry to lay out the new business in advance.

The third is good: short job vacancy

According to the 1111 Manpower Bank's “Intention of Freshman Employment in 2017” survey, the average waiting time for fresh people in 2017 was as high as 2.4 months, which was longer than last year's 1.5 months. The cross-analysis results with the study groups showed that the expected duration of unemployed by the medical and environmental protection study group was the shortest, followed by the business administration/finance/livelihoods group.